Customize Tax Rates

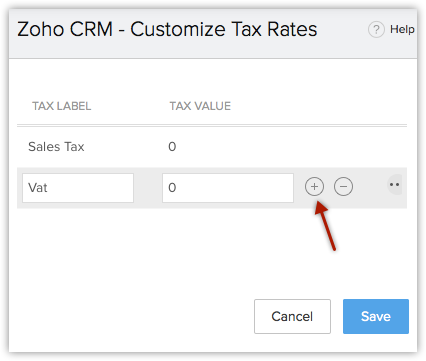

The Tax Rate field allows defining different types of tax rates for the products you sell to your customers. Once the tax rates are added, you can select the tax type and rate while creating a quote, order, or invoice for the customers. For instance, Sales Tax = 10.5 %; VAT = 1%; etc.

Availability

To add Tax Rates

- Log in to CRM with Administrator privileges.

- Click Setup > Customization > Modules.

- Select the Services module from the Modules list view.

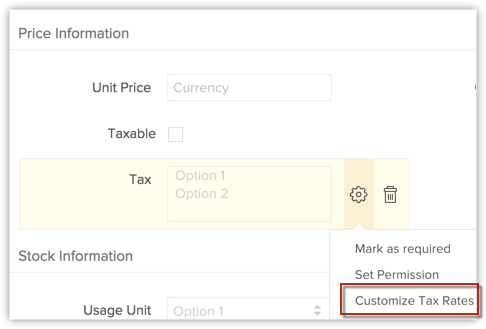

- Scroll down to the Price Information section.

- Click the Settings icon on the Tax field and select Customize Tax Rates option.

- In the pop-up window, click the Add or Delete icons to add new taxes or delete existing taxes, as required.

Click and drag the rows around to rearrange their order. - Click Save.

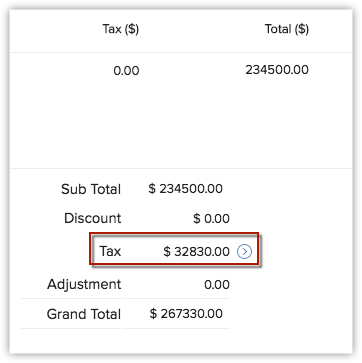

To use Tax Rates

- Click the Invoices tab.

- In the Invoice Home page, click New Invoice.

- In the New Invoice page, specify the customer and product details.

- In the Product Details section, click the Edit icon beside Tax. (after sub totaling the line items).

- In the pop-up that appears, add or modify the tax rates.

- Click Apply.

Related Articles

Can I customize my chat window?

Of course you can, in fact customize every last detail. We want your Visitor Tracking & Live Chat to be uniquely yours, so we made customizing your chat buttons and windows ridiculously straight-forward. You can even upload your own custom CSS coding ...How can I customize the Home tab?

You can customize the Home tab of your CRM account by adding what we call as components. Adding components to the Home tab is like creating a desktop shortcut to your favorite apps on your computer. It’s for quick and easy access to the things that ...How to customize the search layout?

The Search Layout helps you customize the field values that you want to view in search results. For example, when you search leads by name, you may want to view the values from the email, phone, lead type and lead source fields. You can select just ...Customize the Embed’s Display Messages

Go to "Settings". In the Web Embed section, click on the name of the specific embed you would like to edit. In the Configure Messages section, click "Configure Messages" to bring up the specific messages you can edit. Hover over each message you want ...Website Feature: Jumpstart Tax Return